What Are Financial Advisors? The Best Future of Financial Advising

In everyone’s life, everyone has financial goals that they set for themselves and want to achieve. However, many people do not have a clear direction on what to do to turn their goals into reality and spend reasonably. And that’s when you should enlist the help of an expert. Financial advisors can educate you about financial products and insurance options to help you build and secure your finances. So what are financial advisors? What role do they play? The best solution is in this article.

What are financial advisors?

A financial advisor is exactly a financial professional who provides financial advice and advice to an individual or organization. Financial advisors can help individuals and companies achieve their financial goals sooner by providing clients with long-term strategies and ways to create more wealth, reduce costs, or manage money. risk management. They can help you monitor, manage, and balance your portfolio. They can also provide helpful advice on many other financial matters and decisions.

Types of financial advisors

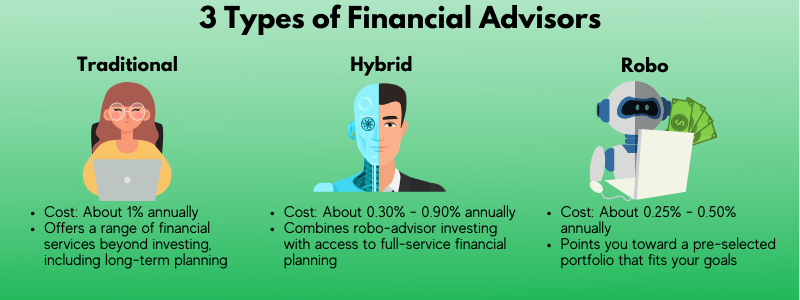

Today, there are many different types of financial advisors. Some of the most popular include:

Traditional financial advisor

These include Certified Financial Planners (CFPs), brokers, Registered Investment Advisors (RIAs) and asset managers. Traditional financial advisors often provide comprehensive, personalized advice regarding your financial life. They can make product recommendations based on your specific situation and goals, invest on your behalf and help ensure you stay on track.

Online financial advisor

This service offers a wider range of options. Online financial planning services are often automated and can help you with financial planning and budgeting, in addition to portfolio building, goal setting, and reporting.

Robot Advisor

A robot advisor is a platform that automatically makes investment recommendations based on the information you enter into the system. It uses algorithms and often artificial intelligence to determine your risk tolerance and what investments might be good to make.

The Roles of financial advisors

Individuals

For individuals, financial advisors can provide insights on how they can save more and build their wealth. This is usually done by building a portfolio tailored to the client’s risk attitude. Some clients accept high risks to invest in potentially large high-return portfolios. Conversely, there are also clients who are more risk-averse and who want a lower-risk portfolio, even if that means lower potential returns. A financial advisor may inquire about an individual’s age, income, marital status or savings to learn more about their client.

Companies

In the case of companies, financial advisors can help provide a second, neutral perspective on company development projects. For example, if a company is considering expanding its operations by building a new factory, financial advisors can help independently assess the profitability of the project. After concluding the advisor’s assessment, they can present their findings to company management with the goal that their analysis will provide company management with a second opinion value.

How Much Does a Financial Advisor Cost?

The services you hire a financial advisor for will determine how much they charge. In general, the average fee a financial advisor charges is 1% of assets under management (AUM). There are also different fees for the different tasks a financial advisor will perform. Many financial advisors charge a flat annual fee of $2,000 to $7,500; from $1,000 to $3,000 to create a suitable financial plan and depending on the deal, a commission of 3% to 6% on the account.

As such, the amount a financial advisor earns will depend on many factors such as experience, area of work, type of client as well as the type of advice they provide. According to the Bureau of Labor Statistics, in 2020, the median salary of a financial advisor is $89,330 per year / $42.95 an hour.

The future of Financial Advising

With today’s ever-evolving technology, many medical companies are choosing to use robotic advisors. Robotic advisors are programs that automatically interpret user information using advanced algorithms and create portfolios geared toward clients’ specific financial goals. It will automate the process of gathering and interpreting information and completing the work of a financial advisor in very little time and with very little cost. Robotic advisors could become a real threat to financial advisors if technology continues to evolve and algorithms become increasingly accurate.

However, there is still a big question mark about the reliability of these robot advisors. Many customers still want to know that their money is being managed by a real person they can talk to and communicate with instead of a computer. However, in a world where financial advisors and investment managers rarely beat market indexes, that is becoming less of a concern.

Conclusion

In today’s article, we have explained what are financial advisors, their classification, roles and future. Overall, Financial Advisors help their clients achieve financial independence and security. They can work independently or as part of a larger company. Their salaries are based on a number of factors, and the average starting salary is much higher than the national average. Consulting with a financial advisor is a smart way to make strides in achieving short- and long-term financial goals.

Read more:

Conclusion: So above is the What Are Financial Advisors? The Best Future of Financial Advising article. Hopefully with this article you can help you in life, always follow and read our good articles on the website: mrsadvisors.com